How is cryptocurrency taxed on Binance?

Today we will analyze two very important events in the crypto world, regarding the introduction of tax reporting on Binance and restrictions on the withdrawal of funds without verification.

Only we will not limit ourselves to this and will dig a little deeper, looking at the reason behind all this, why this is being done, what will happen next and how we should act in this situation.

On July 27, Binance released two very important updates regarding taxes and withdrawals.

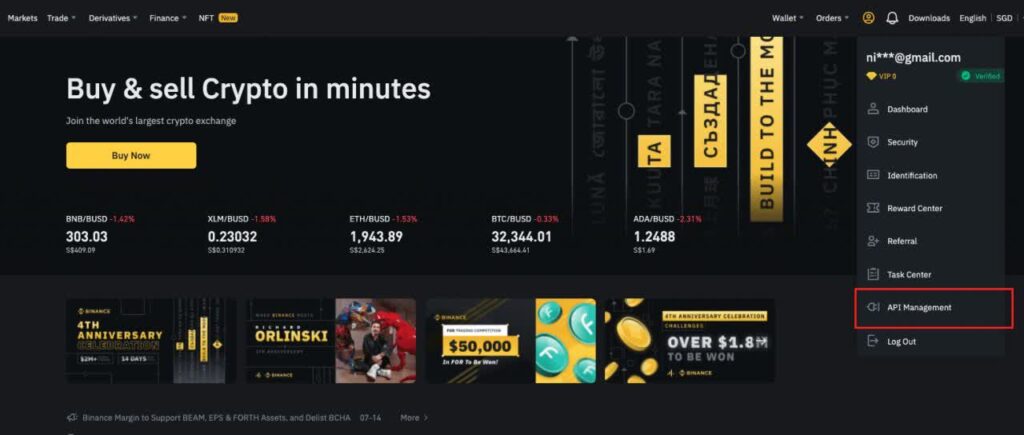

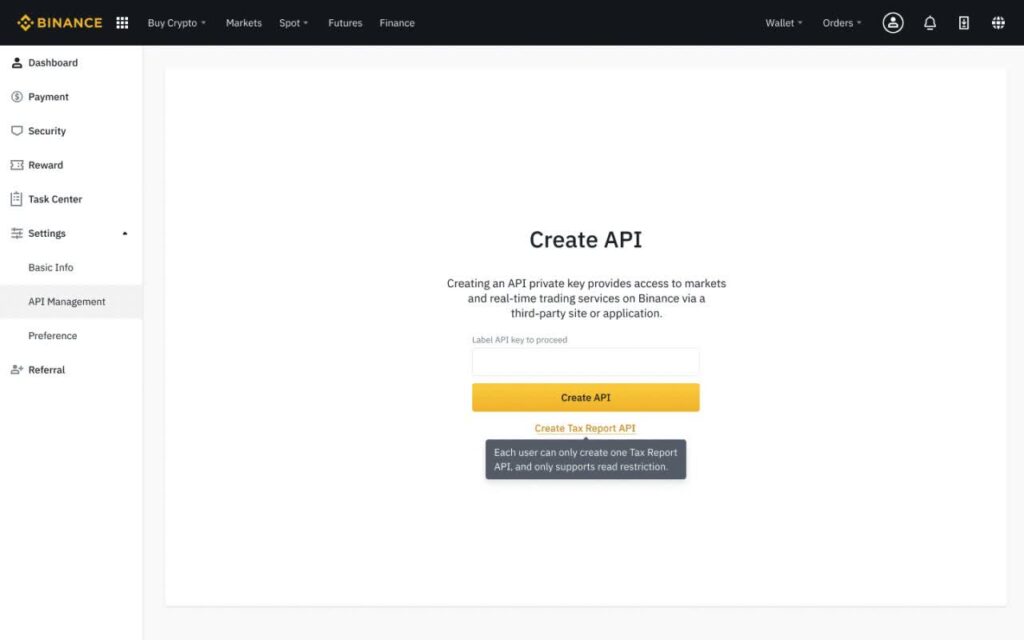

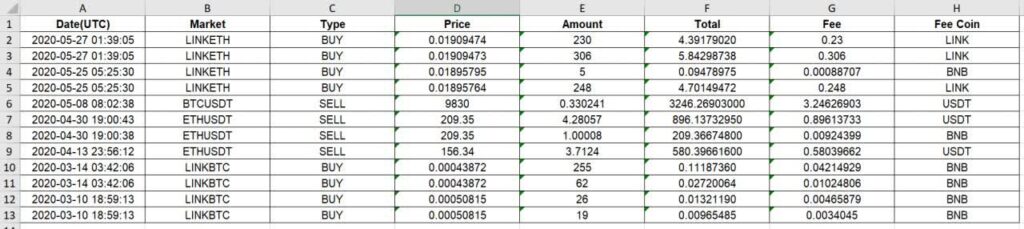

The first one concerns taxes. This means that Binance has already invented and launched a tool that will collect all user’s information and provide access to it in the form of an API key. These are certain keys that can be sent (either manually or automatically) to the tax service, and with the help of this functionality, all information about our account will be automatically sent into the tax service immediately: how much cryptocurrency you have brought to Binance; how much you took out from it; what cryptocurrency you bought and at what price; at what price you sold it; how much did you earn from it; and most importantly, how much taxes you have to pay in the end.

A very important point in order not to panic: in automatic mode, taxes from the Binance platform (or from any other crypto exchange or service) will not be withdrawn, that is, all the money that you have there, all the cryptocurrency, it is there it will remain so.

Also, a very important point worth mentioning is that in automatic mode (at least at the current moment), the data regarding your transactions will not be transferred to the tax office. So far, this is the only voluntary feature that we can use in the form of API for Binance, in order to work more transparently.

How much tax, in what amount, and from what transactions we will need to pay – it completely depends on the country in which you live.

That is, everything here depends on the jurisdiction, so it’s quite individual.

Let’s move on to the second update.

Binance has significantly reduced the amount of withdrawal of platform funds for accounts without verification to 0.06 BTC per day. At the current exchange rate that amount equals $ 2,600.

This means that if you have not yet proceeded with the full account verification, then you will be able to withdraw only $ 2600 from your Binance account. Although most people will probably not be affected by this, because if we have passed the full KYC verification on Binance, we already have all its features.

Now let’s combine these two updates together and get the following information:

If you want to use cryptocurrency in any way (in order to trade, stake, use futures/spot trading), be so kind as to go through identification (full KYC) and pay taxes so that the tax service knows who you are and what you do in general. Otherwise, you will not be able to withdraw your money.

Now let’s figure out what to do next with this information, how we can adapt to it

Let’s start with the fact that this is just the beginning, that Binance has now joined this issue, and, accordingly, this is just such a basic level from where we will start from, and from where regulation will only continue to grow.

It is very important that most jurisdictions (probably even all of ‘em), have not yet developed a particular taxation scheme with cryptocurrencies.

There is no effective scheme for how they can transparently check out your transactions, your income, and how exactly taxes can be derived from this.

This feature is currently only being tested.

In many countries, these kinds of functions are under development stage. And this API taxation feature on Binance will be like a kind of base where each regulator can connect its tax structure and, accordingly, receive information from there.And, in our opinion, such a big tax coup, where the regulators will tackle it tightly, will be (probably) finished by the end of this year, or during this calendar year.

What exactly will the regulation be about?

Here we have two stages in the development of events, that is, one final version, which we most likely will come to, but again, it will occur in stages.

The first stage, which is happening right now, is that regulators will begin to control more tightly the points of entry and exit to and from the cryptocurrency exchange, that is, the places of intersections between fiat money and cryptocurrency, and vice versa (because that stage is the easiest to track at the moment).

This means that they will know how much money you put into the cryptocurrency, how much money you took from there. Also, if you do not trade in a decentralized manner, let’s say you simply enter your deposit on the centralized exchange platform (such as Binance, for example) and leave it there in order to trade, then the regulator, in addition to seeing how much money you have withdrawn, will also know how much you’ve actually earned.

How exactly the tax will be levied on the amount that you have earned, or on the amount that you have withdrawn in fiat money, this issue is still being discussed and there is no specific information at the moment.

Of course, we also have the cashout option, which we will talk about a little later.

That is, when we simply sell our cryptocurrency for cash and, accordingly, it will be very difficult for the regulator to track that we have received some kind of earnings from these transactions.

Or simply withdrawing the cryptocurrency through crypto mixers would do, but then again either through cash out or on some debit cards.

Again, it is already very difficult for the majority of the population to do this at the moment, and then it will become more and more difficult eventually. That is, the options for “black cash” are always present and cryptocurrency is no exception here, but at the current moment when everything is just being processed, it is very difficult to do this.

The first option for regulating cryptocurrency is more long-term, it’ll take more time to come to it. This is a more difficult option. The bottom line is that the state, or some large organizations and corporations, will issue their own cryptocurrency.

Accordingly, certain settlements and payments will take place in this currency or tokens, and these tokens will have some kind of backdoor or such a function as, for example, canceling a payment.

By the way, few people talk about this simply because it is unpopular, not fashionable, and not very much appreciated in the community, but in most cryptocurrencies that are now suitable for such large-scale calculations (at the state level), they already have a backdoor function, and payment cancellation function both.

This functionality will be done as follows: imagine that you are a government agency or some kind of company that issues cryptocurrency on a specific blockchain. Initially, the blockchain has such functionality in these top coins for payment systems that you can cancel any transaction.

That is, it is inscribed in the blockchain, but it happens in such a way that the balance of a certain wallet is burned and then on any other wallet the same balance can be recreated, so to speak. That is, it will no longer be a completely decentralized cryptocurrency, and regulators will have the right to intervene.

Accordingly, this is how this scheme will work. Of course, it doesn’t mean that the regulator will be able to take away cryptocurrency from everyone in a row however they please (simply because it’ll cause some harsh reaction from the crypto community), but anyway that means that the regulators will have a very powerful tool in their hands.

This is neither good nor bad, it is just a fact that such developments are being carried out by banks, and many structures are now actively testing this kind of technology, and for them, it would be a very profitable and useful feature.

Now we use cryptocurrency on most blockchains in a decentralized manner, but this idea will have to be gradually abandoned. If we rely on the fact that the cryptocurrency will be used at the state level, then in any case there will be a certain circle of people or a certain circle of structures that can have a direct impact on our assets.

Second option. This one speaks of a rather distant future (or maybe not so distant). Now we are in a situation where we will need to decide on two things.

The first is what measures should proceed with in regards to our current assets since they are already stored on crypto exchanges, which means that all the information about these assets is already there?

And the second nuance: in the future, whenever we need to buy cryptocurrency – how can we buy it?

As for now the cryptocurrency that we already have in our accounts, we again have two options here: we can either leave our cryptocurrency in our accounts or withdraw it to decentralized storage, in order to trade on decentralized exchanges.

Accordingly, if we just leave our cryptocurrency on a centralized exchange, ideally we would have to pay certain tax interest (depending on your country) on our profits. For example, if we bought one BTC for $ 40 thousand, and then sold the same bitcoin for $ 50 thousand, then we will have to pay the tax interest of $ 10 thousand.

This is how it will work.

In order to do this, at the moment you will just need to fill out a regular income statement.

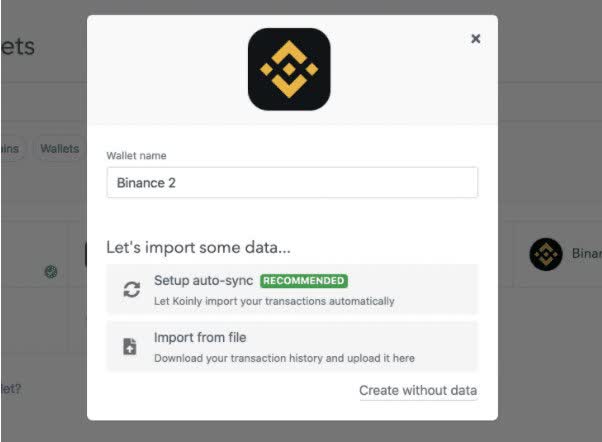

So, if we prefer the option with the withdrawal of funds, then here we will need to get through some steps. If we want to withdraw our funds from centralized storage to decentralized storage, then we will need to do the following:

First, withdraw them from Binance to some decentralized wallet (Metamask, let’s say).

Then it is advisable to run your funds through a cryptocurrency mixer in the process, just so that no connection can be established between them (that is, from which identified wallet this cryptocurrency came to your new wallet).

If you just want to “hold” the cryptocurrency (let’s say, you bought assets earlier and just want to hold them for a couple of years), in theory, there shouldn’t be any particular problems with this option.

However, if you trade cryptocurrencies (that is, you make some kind of trading transactions constantly), whether it is several times a day or several times a month, then you may have certain difficulties.

If we just withdraw our assets, then we either withdraw them to a hot wallet like “Metamask” or withdraw them to a cold wallet like “Tresor” or “Ledger”.

As for cryptocurrency trading: if we want to trade cryptocurrency, do not forget that decentralized cryptocurrency is stored not on the accounts of some exchange, but on its own separate blockchain, and accordingly, in this case, we will immediately have much fewer trading pairs available, then it will be much more difficult for us to trade cryptocurrency.

Of course, we will be able to trade our cryptocurrencies on exchanges such as “Uniswap” or “PancakeSwap” where you can trade cryptocurrencies from different blockchains, and by the way, don’t forget about so-called “bridges”, that is, we can transfer one asset from one blockchain to another, and then subsequently we can trade on that particular blockchain.

But, nevertheless, not all assets have certain bridges, not all assets can be transferred to the blockchain, and accordingly, we are faced with the following problem, especially for “low-liquidity” and unpopular altcoins, that they will not have such a large number of trading pairs, which is available on centralized exchanges.

However, if you are mainly engaged in top cryptocurrency tokens trading, then you most likely will not face such problems.

If we can quickly solve this problem by some workarounds and by choosing only limited trading pairs, then eventually we are faced with the main problem, where there will still be strict government control, namely, the cryptocurrency withdrawal (from cryptocurrency to fiat), either in cash or on the card.

And accordingly, we have two options to get real earnings from our cryptocurrency assets, when it is already in our hands or in the bank account, in case we’ve used a card withdrawal.

This is to sell our cryptocurrency through P2P platforms, either by receiving money on our card or by receiving money in cash.

If we choose a simpler option, namely the sale of our cryptocurrency with a subsequent replenishment of our card, that is, we receive USD on the card, then we are faced with the problem that banks see all this movement of funds and, accordingly, at the request of the regulator, or on their own initiative, they can report it.

There are some ways for solving this problem (and the option with ‘not-paying-taxes’ we haven’t even included, since that’s pretty much as reckless as it can possibly get. IRS will have your ass in the end, so it better not to play with fire).

The option for withdrawing money to the card is under the guise of self-employment. And again, there is a specific list of services that you can provide in order to be considered self-employed.

Trading and making money on cryptocurrencies, or on investments, are not included there, that is, it is completely subject to whatever tax interest is in your country, without any options. In theory, you can declare your income, as well as income from self-employment, by the fact that you provide some services, well, let’s say a massagist at home.

This is again a very gray scheme, if it pops up you’re at risk of running into some serious fines. However, in this case, you can pay fewer taxes if you provide services to individuals, or if you provide services to legal entities.

This is the safer option.

The second option for taking profits, (i.e. withdrawing your cryptocurrency assets into fiat money), is the safest option, in which you simply pay out your entire tax interest from your earnings.

Accordingly, here you will not have any consequences at all in this regard, and you can simply indicate any reason for how you received this money, even if by the same trading or cryptocurrencies.

There will be no questions in 99% of cases.

The only questionable thing would be withdrawing our assets to a certain decentralized exchange when it would be much faster and easier to simply sell our assets on the same Binance through P2P, receive funds much faster, and simply declare our income right there.

If one’s considering the idea to withdraw their crypto through cash, for this, you will first need to find a person who will help you out. The person or organization that deals with this kind of exchange.

They can be found, as a rule, on platforms where you can find P2P trading. There, you simply select the cash option and, accordingly, select the cryptocurrency that you want to sell for cash. What nuances you might need to consider here: this is done in person and here there is a minimum entry threshold for a transaction.

In fact, the exchange rate actually does not differ much from the current official rate, the difference is practically insignificant.

But what should be taken into consideration is the fact that, since you go on a meeting in person with a large amount of money, you can get scammed or even beaten up in a process. Therefore, it is better to conduct this trade with either trusted people or acquaintances.

We have now examined in some detail the option of how we can use our cryptocurrency in case we already have it stored on our accounts on a centralized exchange.

If we do not yet have crypto assets on a centralized exchange, or we already have it, but we plan to buy more, and we do not want to “flash out” this financial movement, then the work process remains the same as described above, the only difference lies in the fact that in addition to safe withdrawal, we also need to deposit our cryptocurrency asset in the same manner.

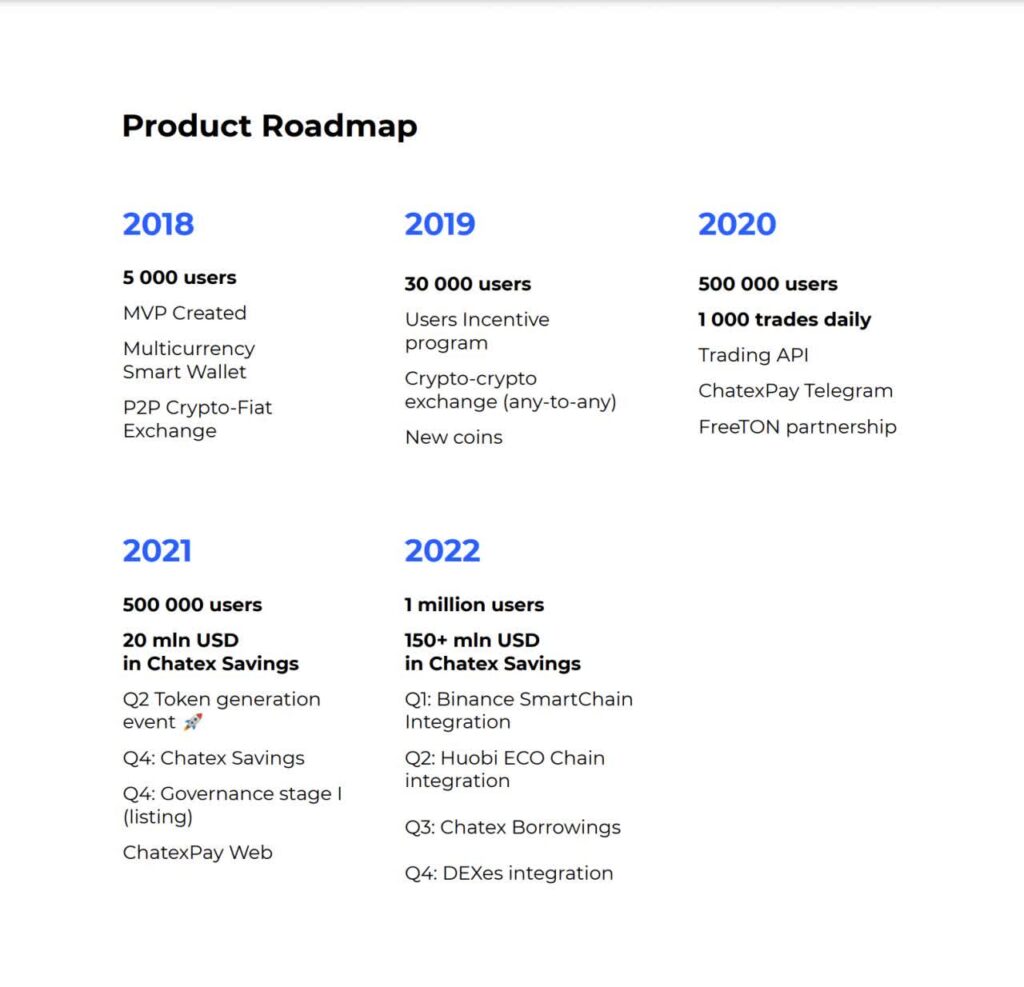

You can buy or sell cryptocurrency anonymously through various services, for example, through Chatex, where you can deposit and withdraw cryptocurrency to fiat using a bank card. Here the transaction takes place in less than five minutes, and up to 1000 euros can be withdrawn per day without verification.

With different levels of verification, you can withdraw even more, up to two million euros, but here we are interested in a “non-verification” option. In most cases, you will not need a passport or a photo of a bank card when making a transaction, therefore, when you make a transaction, carefully read the conditions whether you need a photo of your passport and card or not.

To withdraw our cryptocurrency to fiat, we first need to transfer it to our own wallet in Chatex, which is automatically created there when we launch our bot.

Accordingly, the transfer here happens instantly, immediately after the blockchain processes our transaction.

Further, all we need is to click the exchange button, select the cryptocurrency that we want to sell, select the currency that we want to receive, and the method of receipt, that is, the bank to which we should receive the money.

Next, we enter the exact amount, select the seller whose current exchange rate suits us the most and then we simply proceed with an exchange.

Then we have to wait for a little for the money to be received to the bank card and only after that our cryptocurrency is debited from our balance. Chatex here acts as a guarantor, the platform holds our cryptocurrency until we confirm that the funds have arrived, and in the same way it works in the reverse order.

It is very safe, fast, and convenient (don’t worry, not an AD, they didn’t pay us a cent, even though we’d certainly appreciate if they did).

I would also like to contemplate over the mentioned events and over the context of the situation we’re facing at the moment, like… why is this happening right now? Apart from the fact that more people will start paying taxes…

What are the real consequences of all this?

In terms of context, we can draw the following conclusions: first, you need to look for someone who benefits from such a change.

We think it’s safe to say that this change is not at all profitable for the exchanges, in the sense that they force people to make additional movements, and accordingly, they lose potential customers and potential profit.

This initiative comes from the government regulators because now the government can make a certain profit from these ‘regulations, which are now being introduced to the exchange, that is, they finally paid attention to the field of cryptocurrencies.

Specifically, we cited the Binance exchange as an example, and soon they will come to other exchanges so that they not only go “full KYC”, but also they will probably maintain tax reporting on a grander scale.

Why is this happening now?

Now we are in such a bear market, there is practically no profit now, very few people are taking their profits or withdrawing their funds.

Accordingly, it’s high time to make some changes, so that in case the market goes up, many people will earn, many people will take out a colossal amount of money so that a part of what they received can be taken from these people. Therefore we expect to see some very good “bullish” gains before the end of this year.

This is just a precautionary measure for regulators since they all understand that something will happen soon and these changes need to be made now in order not to miss the margin. Accordingly, we have found someone who benefits from it, why this is done and these are only indirect indicators that we may very soon go into growth.

Now let’s draw some conclusions, to make sure you understood what has been said in this article so far

The first is that regulators have really shifted their focus onto the cryptocurrency system and are starting to get involved in it.

Further, the second point, which we’ve talked about in detail today, is that in the near future we will have to accurately pay taxes on our crypto income because all this information will be available to regulators (through the API keys, most likely).

And here we will need to make a decision for ourselves, whether we leave everything as it is and just continue to work, (in case we use centralized exchanges), and pay our income tax and do not worry about anything at all, or… we somehow try to dodge that bullet and come up with our own ways.

Of course, going down this road, you’re inevitably put yourself at a big risk, so you better take that into account as well.

In this case, if we are using the decentralized path, we also need to think about all the pros and cons. Firstly, we should remember that a decentralized network means paying for a network commission (gas fee), that is, we will pay for this, and secondly, we need to understand that when withdrawing funds, we will also need to pay.

And, thirdly, it’s very important to understand that if we get caught in this, that’d mean that we are doing fraud and do not give the state what it requires from us, at best we will get off with some kind of fine and pay that we had to pay anyway. In the worst scenario you could even end up in jail (probably, if we’re talking thousands of dollars here…or even millions).

Anyway, you are solely responsible for whatever decision you come up with

Now we are already in the very last stage, where we have time to think, weigh some pros and cons of whichever option, contemplate a little, and finally, make some decisions because now the regulators do not yet have a full-fledged effective working mechanism for how taxes will be levied on cryptocurrency earnings.

However, this is already on the way, so it’s better not to postpone it and think it through instead.

Stay tuned folks, we’ll be keeping you updated on the subject.