And how can we use this information to our benefit?

Hola, friends!

So, we hope that the previous information about the work of decentralized exchanges (DeFi) was already well absorbed by you and, as we promised, this article will move from theory to practice.

How does the liquidity pool work in practice?

Let’s start with an example. Let’s say we create 10 exclusive coins, to which we allocate an amount of $ 100 as backing. Then we add them to PancakeSwap, and voila – we have our pool of liquidity, and users buy shares in this pool.

So, what happens next?

A little math for you

Until the moment of the first purchase, the price will be equal to $ 10, since all coins are in the pool and are not redeemed by anyone. The very first purchase will immediately increase the rate of our coin (say, conditionally up to $ 13.5). The third and subsequent purchases will raise the rate by a few more points ($ 15.5).

Do you understand?

The price of a coin in the pool changes depending on the ratio, and according to the ratio of coins in the pool to redeemed coins, this or that asset will be allocated.

The same works the other way around.

Thus if the holder of the coin wants to sell part of his share, then the price will decrease, since, by this fact of the sale, you will essentially take away some of the collateral (or “backing”, whichever term you prefer).

Thus, when buying shares of the coins of a given pool, the price of a coin will grow exponentially and can potentially reach impressive amounts.

Accordingly, the last shares of a given coin in the pool will be the most valuable in terms of value.

How exactly can you make money by providing your liquidity?

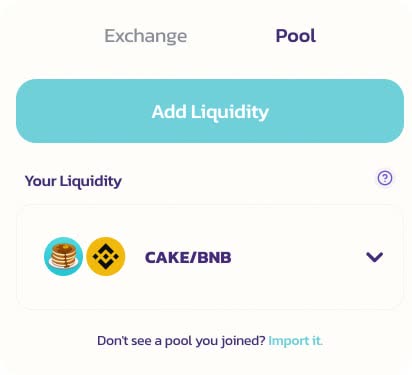

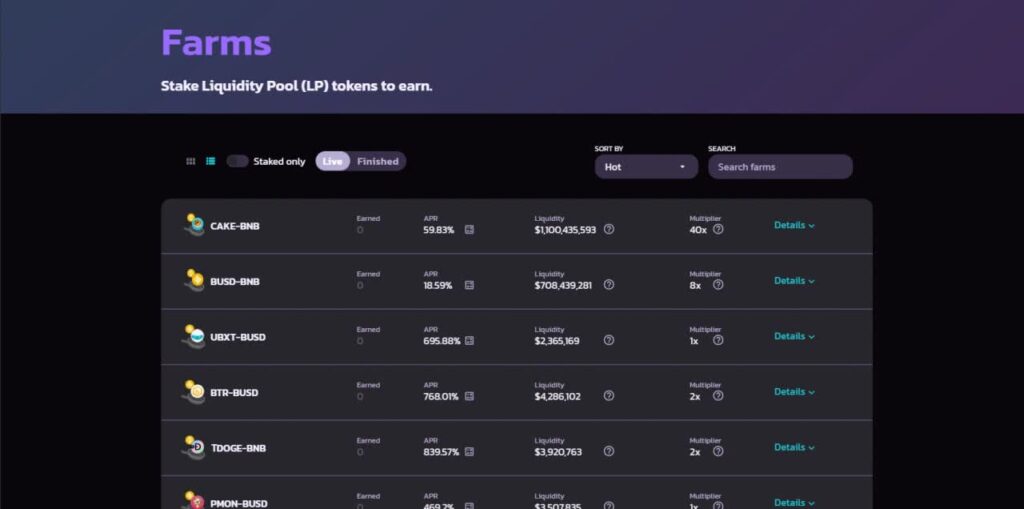

For adding your liquid pair into the corresponding pool, the platform (as you remember, we use Pancake as an example) will provide you with the corresponding liquidity pool token (LP) for this specific liquid pair.

For example, it can be a CAKE-LP token.

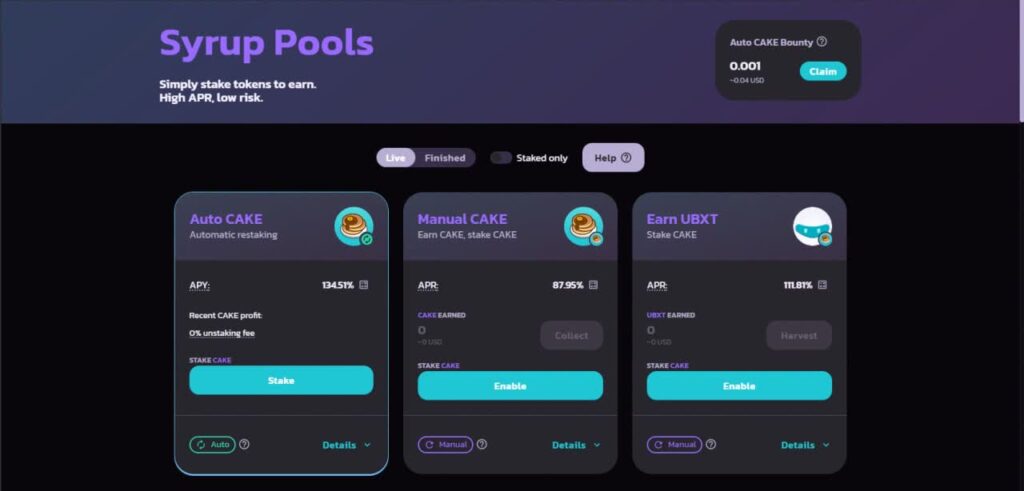

Or, in the case of pharming, these can be ordinary CAKE tokens (which token it’ll be – depends on the particular liquidity pool).

This token can either a) be sold, i.e. immediately exchanged for stable coins, such as BUSD or USDT, or b) you can continue to accumulate them, with the aim of further selling at an increased price.Interest in pools varies, but usually, their value depends on a simple formula – the more risky the pool, the higher the percentage.

Impermanent loss

What is Impermanent loss, you may ask?

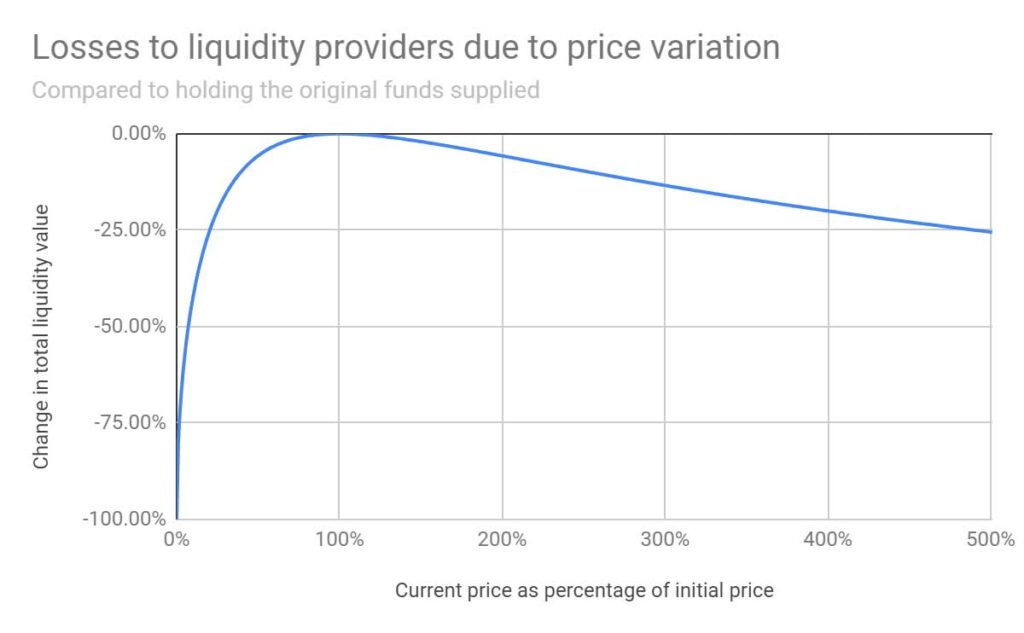

If one of the tokens in a liquid pair increases in price, in practice this means that its share in this pair becomes smaller, i.e. there is a redistribution of the number of coins in a pair.

Accordingly, when you withdraw these coins from the platform, you will no longer receive the amount that you’ve inserted earlier, but the amount with a different, actual ratio of coins.

In general, our recommendations are as follows: if you are creating a liquid pair / choosing a suitable pool for farming – try to choose such pairs in which BOTH coins either a) are of equal value to you or b) to which you are equally indifferent.

That’s all for today, I hope the article was useful to you. Stay tuned, we will continue to post articles on DeFi platforms in the future.

Adios!